If the object is to use a petrol tax (carbon tax) to reduce global carbo emissions, it has to be:

1. Legislated by government.

2. Target towards the purchase of things used to either use more solar energy directly, or substitute solar and renewable energy sources for traditional fossil fuels.

There is likely to be a global energy shortage anyway, and this combined with increasing difficulty in growing traditional crops means compounding problems. It is therefore that action is taken urgently, and not delayed for another year, and another after that.

It is anticipated that world mean global temperatures will rise, first by half a degree anually, then two degrees anually, and then five degrees anually, not just a slow and steady .5 of a degree per year. This could mean extinction of up to 90% of the world's population. Is it likely?

If taxpayers are the recipients of the suggested $500 payment, why pay ratepayers, and not just the petrol buying public?

We could just give out a voucher for $500 or even $200 to go toward the purchase of motor spirit containing 10% ethanol, as Gull service stations already provide. But this is not going to solve the problem, neither is offering a 20% ethanol blend.

If the payment is made to those who own houses, and who pay rates (property tax) and those who own property and rent it out, at the rate of $500 for up to .5 of a hectare, and for farmers who own property of 2.5 or in excess of 2.5 hectares, and who have at least 2.5 hectares of trees on that property, at the rate of up to $2,500 per property, it will enable those property owners to use their roof space to install a solar system. This could easily generate electricity to the value of $2,000 per property, based on the savings made with a solar hot water system alone. It all depends upon the efficiency of the solar panels, but even with the arsenic/boron panels considerable electricity can be generated and fed into the national grid. They are still expensive compared to other methods of producing electricity such as coal and hydro electricity, however there is the need to use more sunlight in ways other than just growing plants and producing alcohol or methanol.

Costs for solar cells have continued to fall. There is also another consideration. If the price is $1.10 to $2.00 per watt, ($2,000 per kilowatt, or unit), the cost of 10 units is $20,000 and this would take some time to pay for itself.

However, 1 unit per hour can generate for several hours per day, and could produce 10 units over a day, meaning the capital cost is not $20,000, but $2,000. Half a unit is enough to power the pump on a solar hot water panel. Even with battery storage and a rectifier to convert DC current to AC power, the economics make sense.

If the manufacturing base in in China or India there are considerable exchange rate savings, so a scheme where 20% of teh product are exported back to the country of manufacture, 40% used domestically, and 40% exported to another country like the united states makes sense and brings possibilities of economies of scale in the manufacture.

The proposal I'm putting forward for a 10% tax on carbon (possibly 5% un the USA), rising by 1% per year, and returning $500 to the household has one more thing preventing it.

It may be necessary to boost the wages of the lowest paid (those earning the minimum), by up to $2 per hour to make it possible to cover the inflationary effects of a fuel tax. This means $6 per hour for those earning three times the minimum. Some employers would have difficulty, and may only be able to afford $1 per hour.

In teh first year, the payment would be purely cash, and paid as a credit to the rates bill, giving some immediate relief to those struggling to make the books balance. This would give time for the scheme to settle in, and if the payment didn't come until the tax had been in place for a full year, would give the government a little extra tax revinue to invest for a short time. It would however do little to solve the global warming crisis.

There would be nothing however to stop electricity retailers and local councils from ordering and beginning finance schemes for those who decided to invest in solar electricity

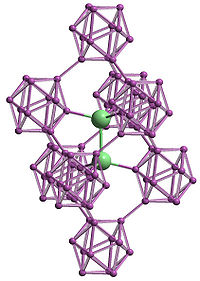

Boron arsenide is a chemical compound of boron and arsenic. It is a cubic (sphalerite) semiconductor with a lattice constant of 0.4777 nm and an indirect bandgap of roughly 1.5 eV. It can be alloyed with gallium arsenide.

Boron arsenide also occurs as an icosahedral boride, B12As2.[1] It belongs to R-3m space group with a rhombohedral structure based on clusters of boron atoms and two-atom As-As chains. It's a wide bandgap semiconductor (3.47 eV) with the extraordinary ability to “self-heal” radiation damage. This form can be grown on substrates such as silicon carbide.

Solar cells can be fabricated from boron arsenide. It's also an attractive choice for devices exposed to radiation which can severely degrade the electrical properties of conventional semiconductors, causing devices to cease functioning. Among the particularly intriguing possible applications for B12As2 are beta cells, devices capable of producing electrical energy by coupling a radioactive beta emitter to a semiconductor junction, another space electronics

Solar cell pricing

In the late 1960s, Elliot Berman was investigating a new method for producing the silicon feedstock in a ribbon process.

Putting all of these changes into practice, the company started buying up "reject" silicon from existing manufacturers at very low cost. By using the largest wafers available, thereby reducing the amount of wiring for a given panel area, and packaging them into panels using their new methods, by 1973 SPC was producing panels at $10 per watt and selling them at $20 per watt, a fivefold decrease in prices in two years.

Other technologies have tried to enter the market. First Solar was briefly the largest panel manufacturer in 2009, in terms of yearly power produced, using a thin-film cell sandwiched between two layers of glass. Since then Silicon panels reasserted their dominant position both in terms of lower prices and the rapid rise of Chinese manufacturing, resulting in the top producers being Chinese. By late 2011, efficient production in China, coupled with a drop in European demand due to budgetary turmoil had dropped prices for crystalline solar-based modules further, to about $1.09[11] per watt in October 2011, down sharply from from the price per watt in 2010.